Writing a personal or joint will is essential, and reducing the absolute power of attorney and their fixed price has finally been achieved by writing your will online.

Online will is the will you create using the digital platform data. It is affordable even for low-income earners because it is cost-effective and sometimes free. Moreover, writing wills online today is convenient and easy to complete.

Online forms for creating a will is straightforward and understandable. Also, protecting a will that was once a severe matter now involves an easy process—all thanks to technological advancement.

When we talk about writing a will online and including all the relevant information, we’re talking about an online will. It does not imply that you won’t require legal counsel or the printing services of a good law firm.

For the document to be legally valid, you will still need to print it and sign it before at least two witnesses.

Any digital copy you make online, whether scanned in a softcopy or snapped, must go through additional steps before it can be legally used.

The online will must first be converted to a hard copy format and properly appended before storage, even if you keep it in the cloud. In addition, for your online will to be legally binding in Australia, you will need a legally sound attorney to sign it.

Two witnesses will also be present for the signing of the attorney documents. Additionally, we cannot use the electronic or online version of the will once it is ready for probate. A hard copy will need to be made.

Therefore, an online will service is a straightforward process service that assists you in creating your will using the digital platform.

Nevertheless, you must create a hard copy and follow the proper procedures. Therefore, now is the time to think about the five essential justifications for online will creation.

What You Should Not Include In Your Online Will

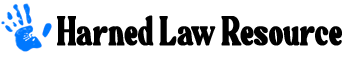

An estate plan, which enables you to prepare for your estate when you pass away, is built on a final legal will and testament. You might not want to include some things in your online will, though.

In general, final wishes and testament is a simple process to specify what will happen to your property after your passing and to choose a guardian for any minor children.

Your future heirs will receive their inheritance more quickly if you omit some items from your online will, such as property held in trust, accounts payable on death, and anything else you don’t own outright.

Before your possessions are dispersed to your loved ones after your death, the validity of your will must be established in court. https://harnedlaw.com/step-by-step-guide-on-how-to-make-an-online-will-in-australia/ Check out this link about how to properly write online will in Australia.

Probation is a time-consuming process that may take longer if there are problems or the will is incorrect. For example, if you write something unnecessary in your will, it could cause a delay in the probate process and perhaps lead to a will contest.

Finally, nothing you do not own should be written in your will. If you jointly own property with someone, they will probably take over ownership. Property obtained by a married partner in states with community property is where this most frequently occurs.

Jointly-owned property

You shouldn’t include property you jointly purchase with a partner in your will because it will nearly usually pass to the co-owner directly after your death.

For instance, if you and your sibling share ownership of stocks in a brokerage account, they will continue to own the title to the account and the investments in it even after your death. combine tenancy with rights of survivorship is the legal term for this situation.

In other instances, even though neither of your names is specifically included on the account or asset, you may jointly own property with another person.

Anything you acquire during your marriage may be regarded as community property in states where ownership is divided equally between you and your spouse. Since your spouse is entitled to community property after your death, there is no need to include it in your will.

Property with Beneficiary names

Some financial accounts and assets are receivable or transferrable upon death. They are given or paid to the designated beneficiaries directly. Therefore placing them in a will is unnecessary (and could be annoying if you’re inconsistent).

However, you can mention details about these special gifts in your letter of instructions.

Trust Asset

It’s essential to manage contradictions because trust functions independently. Therefore you shouldn’t leave anything in your will that the trust won’t handle and distribute according to its rules. Trusts are a popular method of avoiding probate in estate planning. click here to learn more about estate planning.

The trust’s regulations, outlined in the trust instrument and not the will, take effect when you transfer property into the trust.

Business Interests

Although you can bequeath business holdings through your will, there are complex situations when you might not want to. Wills must be legally validated in court, which might take some time and make the transfer after your death difficult.

Additionally, the succession may be challenged. You might wish to consult with an estate planning lawyer who can assist you in adequately arranging your firm’s succession so that it causes your business partners and family less stress. As a business owner, they can even help with any estate tax problems you encounter.

Conditional Gifts

You can specify who gets what in a will (for example, “my niece gets my car”), but you shouldn’t include conditions (for example, “my niece gets my car, but only if she uses it to get to school”) because no one can legally compel someone to follow them.

You could be better off setting up a trust if you have clear instructions for how someone should handle their inheritance, whether they are a spendthrift or someone with special needs. This will give you more control over your beneficiaries, even after passing away.

Funeral Service Instructions

Given that the family members might not have access to the will before making arrangements, a funeral service in a will may not be as helpful. Instead, try contacting your executor in advance to ensure that your intentions are carried out.

A letter of instruction, a more casual document intended to convey this information and express personal sentiments, is generally the best place to retain personal wants and desires without additional costs.

Final Thought

It could be more challenging to deal with specific scenarios in a will. Consider additional estate planning choices that would better suit your needs if you have a blended family or a child with special needs.

When the beneficiary must meet specific requirements to receive government benefits, such as Medicaid, a will may not always be the best approach to leave everything to them.

Writing your will in plain English or a language understood by everyone gives you peace of mind and serves as your lasting legacy when you transcend to the after-life